Most undergraduates today are juggling academics with paid work, many logging 40 or more hours a week. That load leaves little margin: more non-academic responsibilities, less time for coursework, and fewer opportunities to engage on campus mean these students often feel the effects of federal policy changes first.

The budget reconciliation bill signed into law on July 4 threatens to make those challenges worse, reshaping student loans and public benefit programs like the Supplemental Nutrition Assistance Program (SNAP) and Medicaid in ways that risk cutting off critical financial lifelines. On Pell Grants, the news is mixed: the bill restores a revised Workforce Pell program that could open doors to short-term training, but makes other changes that may reduce access for some students.

For working students already balancing jobs, school, and basic needs, these changes could tip the balance toward longer time to degree, greater debt, or leaving school altogether. Using recent data, we explore how these students are making ends meet now, and what colleges, universities, and policymakers can do to protect and strengthen the supports that help them stay enrolled and graduate.

Profile of student workers

According to the 2020 National Postsecondary Student Aid Study (NPSAS:20), nearly three-quarters of undergraduate students work while enrolled, with around a third of those students working full time. Results from Trellis Strategies’ 2024 Student Financial Wellness Survey (SFWS) identified similar rates of employment, allowing the ability to cross-reference specific questions about overall financial wellness. In this post, we compare SFWS respondents who answered “yes” to the question “Do you work for pay?” with those who answered “no.”

About half of all SFWS respondents reported using income from their employment to pay for school. However, many working students have additional financial commitments beyond their education. For example, 19 percent of working respondents indicated they provide financial support to a child, and 18 percent provide the same support to their parents or guardians. Overall, about half of working SFWS respondents (47 percent) shared that it was important for them to support their family financially while in college, compared to 38 percent of their non-working peers.

This heightened familial commitment is reflected in the fact that many working students—36 percent of those responding to the 2024 SFWS—identify primarily as workers who go to school, rather than students who work. Furthermore, working students attend part-time at higher rates (38 percent) compared to their non-working peers (28 percent).

How working students pay for college

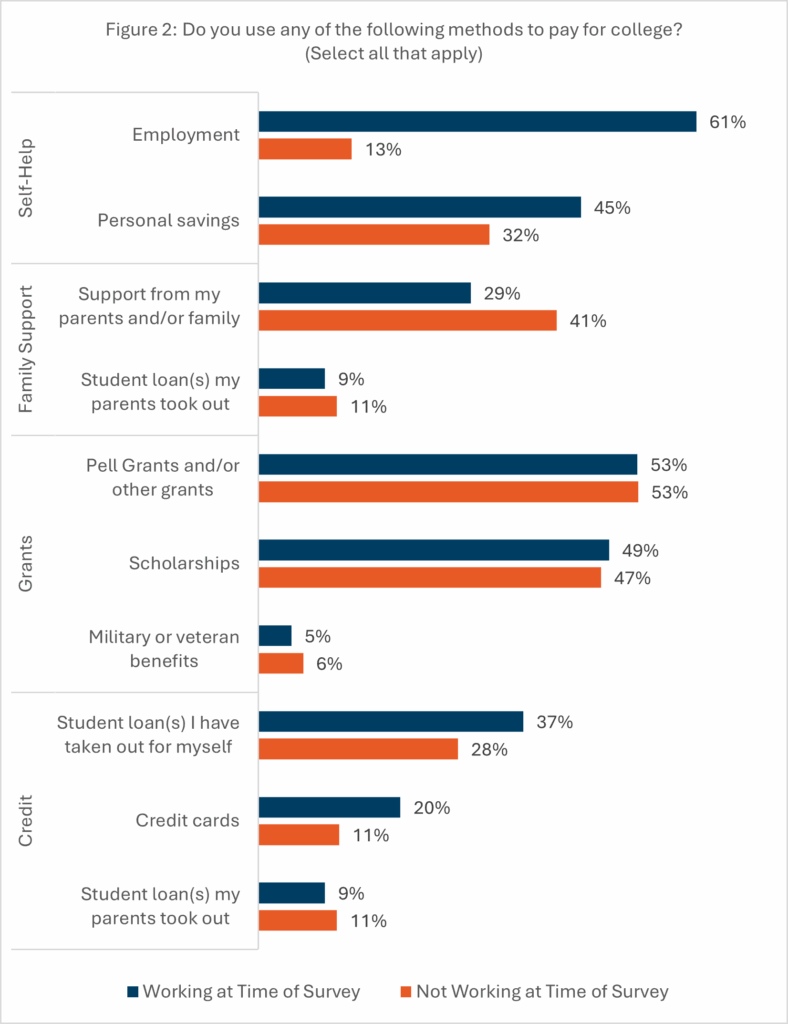

Most students who were working at the time the 2024 SFWS was administered self-reported using their employment to pay for college (see Figure 2). Many used personal savings as well, but only seven percent were able to “work their way through college” using employment and/or personal savings alone. Instead, working students, similar to their peers who don’t work, depend upon aid such as grants and loans to be able to access higher education.

Nationally representative data from NPSAS:20 show that almost 40 percent of working students receive Pell Grants and more than a third borrow federal student loans (non-working students receive federal aid at similar rates).

For these students, losing part of their federal aid could mean they can no longer afford higher education. This is especially true for those students with limited financial flexibility to fall back on. Working students in the SFWS were more likely to report using credit cards to pay for college and were less likely to receive financial support from parents or family, as compared to their non-working peers.

Implications of policy changes

The reconciliation bill passed by Congress in July 2025 (the One Big Beautiful Bill Act) includes many changes that impact students, with particularly significant consequences for those who work.

On Pell Grants, the bill offers both opportunities and new concerns. It restores a revised Workforce Pell Grant program, starting July 2026, that expands the traditional Pell Grant to include eligible short-term non-degree programs at accredited institutions, an option that could help working students earn credentials more quickly and move into higher-paying jobs.

At the same time, the bill restricts Pell eligibility when other scholarships, grants, or non-federal aid fully cover a student’s cost of attendance. Under this system, a working student who receives a private scholarship that might otherwise allow them to decrease their working hours could instead see their Pell Grant decrease. While intended to prevent Pell from being awarded in “full-ride” situations, the change could also affect working students who have substantial financial responsibilities beyond the calculated cost of attendance.

The bill also includes significant changes to federal student loan programs and repayment options, with most of the changes effective as of July 1, 2026. Parents borrowing Parent PLUS loans will now have annual and aggregate borrowing caps. About one in 10 undergraduate students, including among working students, reported that their parents borrowed loans for their education. Limits on this borrowing may constrain the financial resources of some students, with possible negative consequences for their academic momentum.

Changes to SNAP and Medicaid will affect state budgets, putting higher education at risk and making it harder for people to enroll in and complete a credential while meeting their basic needs. Many students, despite also working, already face significant barriers such as food and housing insecurity, as found in the 2024 SFWS.

While no changes were made to student-specific eligibility criteria in SNAP, new work requirements in SNAP and Medicaid prioritize work over education, making it harder for people to complete a credential while maintaining access to food and health assistance. These work requirements will also create new administrative hurdles, which research shows result in people being kicked off of Medicaid despite being eligible.

The net effect of these changes will relegate more people to low-wage work by delaying or denying their ability to complete credentials that would provide higher wages, lower unemployment and poverty rates, and less use of public benefits. While the Medicaid work requirement changes don’t begin until January 2028, the SNAP changes were effective upon signing of the bill. However, states are awaiting further guidance from the U.S. Department of Agriculture on how to administer those changes.

Any reduction in financial aid or public assistance resources for students may mean that more students will need to work longer hours while enrolled to make ends meet. Besides reducing the number of hours available to study, work schedules can also directly conflict with class schedules and other campus activities.One-quarter of working respondents in the 2024 SFWS reported missing at least one day of classes due to conflicts with their job, and 56 percent of students with jobs agreed or strongly agreed that their job interfered with their ability to engage in extracurricular activities or social events at their school. Students with a weaker sense of connection and belonging at their institution have been shown to have worse academic performance and retention rates than their peers.

Supporting working students

While changes to federal student aid programs are still being debated, colleges and universities can ensure they have programs and processes in place to support working students at their campuses. Institutional leaders can:

- Develop or enhance robust support systems, such as emergency grants, connection to public services, and adequate financial aid, to help students weather financial challenges, develop a stronger connection to their institution, and remain enrolled.

- Implement strategic course scheduling that can help students more effectively plan employment, child care, transportation, and other needs so they can enroll in and complete more classes in a timely way.

- Leverage regular data collection to respond to the needs of their specific student body. Participating in the annual Student Financial Wellness Survey is free and provides institutions with a customized report, benchmarking insights, and de-identified student data.

- Policymakers should consider how programs can best serve students juggling multiple time commitments and financial priorities. Robust social services, such as child care and access to public assistance programs, can allow more working students the opportunity to thrive. Adequate financial aid can help students work less and complete their credentials sooner, opening the door to higher wages.

If you have any questions or comments about this blog post, please contact us.